by Vickie Jenkins

The Birth Center at Deaconess hospital features eighteen elegantly appointed single-room maternity suites that allow mothers to share the birth experience with family in a beautiful, home-like atmosphere by staying in the same room for labor, delivery, recovery and postpartum care. Nine-bed level-II NICU provides excellent care for babies who need additional medical attention. The NICU is staffed by registered nurses and board-certified neonatologists. One-on-one nurse to patient ratio throughout the entire labor and delivery process.

Deaconess Hospital in Oklahoma City is known for their outstanding doctors and nurses. Picture: From L-R: Tanya Bogan, RN, Yvonne Silberman RNC-OB, Jonna Criscuoli, RN and Supervisor Trisha Brown, RNC-OB show the Sleep Sack Swaddle that each newborn receives at Deaconess. The Sleep Sack is a Safe Sleep Initiative that was introduced February 14, 2014.

Here are some Safe Sleep Swaddle Tips to ensure a safe sleep for your baby. Always place baby to sleep on his or her back at naptime and night time. Use a crib that meets current safety standards with a firm mattress that fits snugly and is covered with only a tight-fitting crib sheet. Remove all blankets, comforters and toys from your baby’s sleep area (this includes loose blankets, bumpers, pillows and positioners). The American Academy of Pediatrics suggests using a wearable blanket instead of loose blankets to keep your baby warm. Offer a pacifier when putting baby to sleep. If breastfeeding, introduce pacifier after one month or after breastfeeding has been established. Breastfeed, if possible, but when finished, put your baby back to sleep in his or her separate safe sleep area alongside your bed. Room share, but don’t bed share. Bed sharing can put a child at risk of suffocation. Never put your baby to sleep on any soft surface (adult beds, sofas, chairs, water beds, quilts, sheep skins etc.) Never dress your baby too warmly for sleep. Never allow anyone to smoke around your baby. Deaconess Hospital is proud of their new Hugs and Kisses Security System as of January 2015. The Hugs system offers the reliability that you and your staff can depend on every day to keep your infants safe. The Hugs tag attaches in seconds and is automatically enrolled in the software. Protection can start right in the delivery room. The Hugs system requires no manual checks of infant tags or other devices to make sure they’re working. The Hugs system software -continually monitors the status of all devices, and will generate an alarm if something goes wrong. There is an automatic mother/infant matching. With the Kisses® option, the Hugs system automatically confirms that the right baby is with the right mother. There are no buttons to push and no numbers to match.

Deaconess Hospital offers Certified Lactation Consultants that round on all post-partum and NICU mothers. Here you will find Neonatologists and Neonatal Nurse Practitioners on call 24/7 for high risk deliveries.

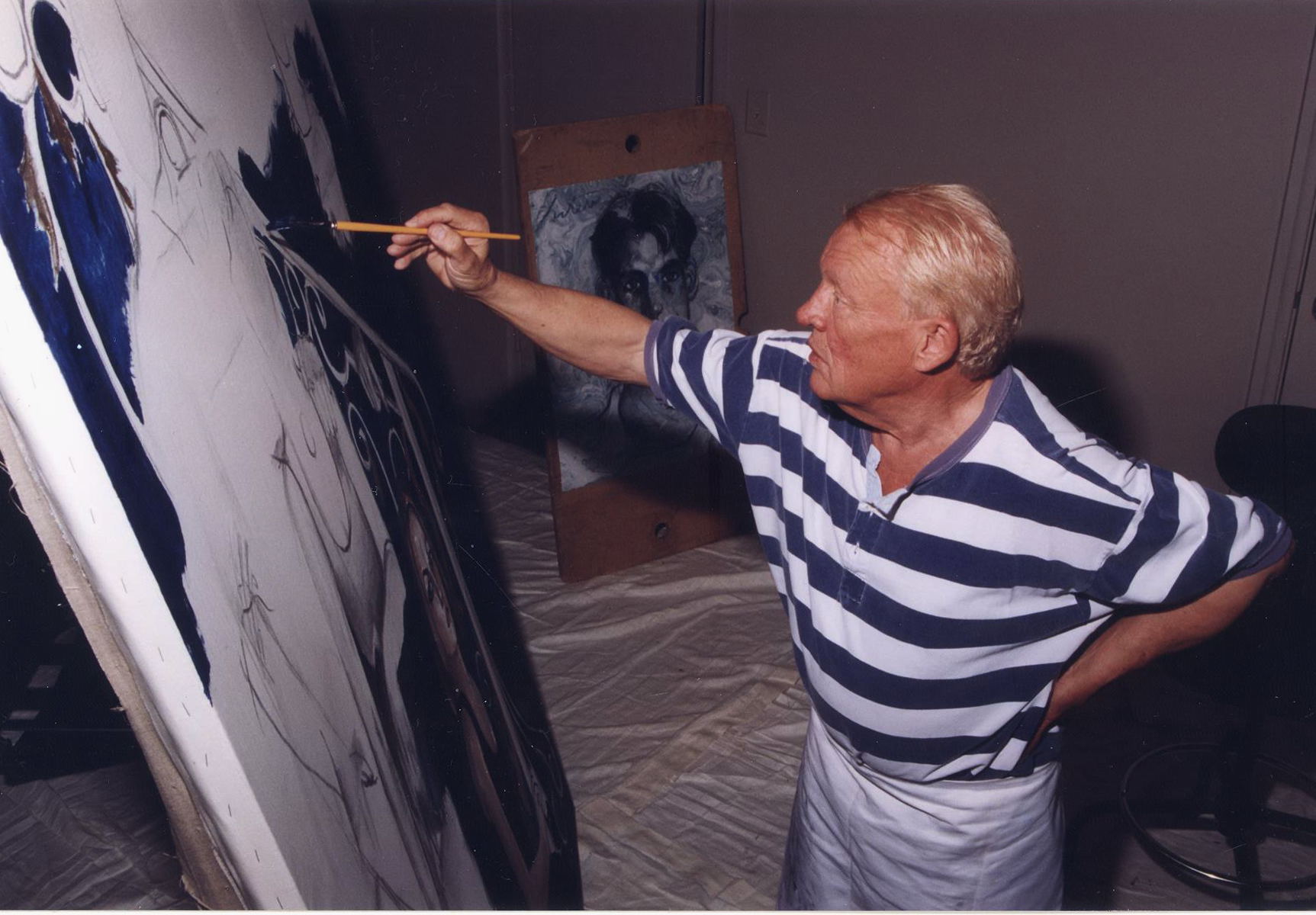

Artist Harold Stevenson honored at Oklahoma’s Fred Jones Junior Museum of Art

Artist Harold Stevenson honored at Oklahoma’s Fred Jones Junior Museum of Art