VOLUNTEERS NEEDED

Make a Difference Volunteering for Resident’s in Long-Term Care

The Long-Term Care Ombudsman Program serves residents in nursing homes, assisted living centers and residential care homes. An Ombudsman helps to improve the quality of care and life for the residents living in long-term care communities. As a friendly visitor and advocate, the volunteer has many opportunities to be of service and enrich the lives of the residents. Many residents never have a visitor after moving to a long-term care facility.

If you are interested in making a difference in the lives of residents in Canadian, Cleveland, Logan or Oklahoma Counties, we have opportunities waiting for you. If you are willing to be that friendly face and advocacy helper, it only takes a desire to be the difference in someone’s life. Potential volunteers are required to complete a two-day training class, become designated to a facility, attend a once a month educational training meeting, and commit to a minimum of only 2 hours per week visiting with residents. Sound simple? It is! Such a small sacrifice to make a huge impact in the lives of so many. Our aging community deserves a happy life. Will you help deliver some happiness?

The next training will be January 24th & 25th, 2018 held at Areawide Aging Agency, located at 4101 Perimeter Center Drive, Suite 310, Oklahoma City, Oklahoma. There is no cost involved and refreshments will be served, but lunch is on your own. Each day classes begin at 9:00 a.m. and will adjourn at 3:00 p.m. This is a FREE 2-day training. If you are interested in becoming a volunteer, or just want to learn more about the Long-Term Care Ombudsman Program, please RSVP by January 17,2018. Please contact Ombudsman Supervisor Tonya VanScoyoc, (405)942-8500. Hurry!! There’s limited seating so register to attend in order to save your seat.

SPECIAL NOTICE: Oklahoma Home and Community Education Presents

“Internet Food Safety Myths”

This event is free to the public. The internet is a great resource for many things, but there is a lot of misinformation, especially about food safety. Learn about some common internet food safety myths and what to do instead to keep you and your family safe. The class will be taught by Kelsey Ratcliff, an FCS area Specialist in Health Disparities. Come join us at 9:30 AM, Thursday, September 22, at the Extension Conference Center, 2500 NE 63rd Street, OKC. There is no charge for the class.

OKC ZOO PLEDGES CONSERVATION FUNDS TO HELP SAVE “LITTLE” PORPOISE

Outpouring of Care and Support Brings Endangered Porpoise Closer to Safe Waters

When just 30 animals of a specific species are left in the world, the zoo and aquarium communities accredited through the Association of Zoos and Aquariums (AZA) are compelled to act. The Oklahoma City Zoo and Botanical Garden has partnered with over 100 other AZA-accredited institutions to help save the vaquita (Vah-KEE-tah) porpoise from extinction. Vaquitas, or “little cows” in Spanish, are the smallest and most endangered cetacean in the world.

To date, AZA organizations have contributed over $1 million toward the emergency rescue of the Vaquita. AZA and its members are joining the Mexican government, which today announced that it is pledging up to $3 million to support the VaquitaCPR emergency rescue plan. VaquitaCPR (Conservation, Protection and Recovery) is an emergency action plan led by the Mexican government, with the input of an expert group of conservation scientists and marine mammal veterinarians. The Zoo has pledged $5,000 from its Round Up for Conservation emergency intervention funds, collected from Zoo guests who volunteer to “round up” to the next dollar amount on purchases made at the Zoo.

“Without these combined rescue efforts, the vaquita will soon be extinct,” said Dr. Rebecca Snyder, Zoo curator of conservation and science. “We are fortunate to have these funds from our home-base conservation fundraising effort for emergencies such as the VaquitaCPR emergency rescue plan.”

Vaquita can easily become entangled and subsequently drown in gill nets used to illegally catch other species, including the endangered totoaba fish, found off the coasts of the northwestern corner of the Gulf of California, Mexico. The fish’s swim bladder is used in traditional Chinese medicine. In addition to securing funds, AZA is teaming up with other conservation organizations to capture the remaining vaquita and place them in sea pens to try to establish a protected assurance colony.

The Zoo is a founding member of the AZA’s Saving Animals From Extinction (SAFE) program and the vaquita is one of the 10 signature SAFE species. AZA institutions have played a key role in bringing back other species from the verge of extinction by establishing protective housing and breeding programs, such as for the California condor, Arabian oryx, golden lion tamarin and American bison. This expertise provided by AZA members is very valuable to the Vaquita Rescue Effort. The Zoo has other SAFE species in its animal collection, including the Asian elephant, gorilla, cheetah and shark.

Donations to the VaquitaCPR emergency rescue plan can be made through the Zoo by calling the ZOOfriends’ office at (405) 425-0611 or can be made online at www.VaquitaCPR.org.. A complete list of the AZA-accredited facilities that have contributed to the AZA SAFE Vaquita Rescue Plan can be found online at https://www.aza.org/donors-to-the-aza-safe-vaquita-rescue-project. To review the AZA SAFE Vaquita Conservation Action Plan, visit https://www.aza.org/safe-vaquita-conservation-projects.

Show your support for all the little and large animals of the world. Round Up for Conservation with every purchase at the Zoo!

OMRF receives pair of grants to study aging

Two scientists at the Oklahoma Medical Research Foundation have been awarded grants for research aimed at extending the period of good health as we age.

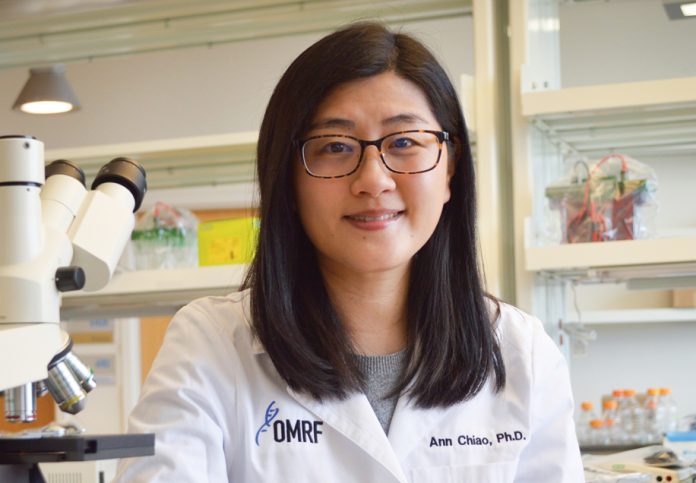

The American Federation for Aging Research and the Glenn Foundation for Medical Research awarded grants to OMRF’s Ann Chiao, Ph.D., and Matt Bubak, Ph.D. The organizations work together to support junior researchers focused on the basic biology of aging.

Chiao received a two-year, $125,000 grant from AFAR to better understand a molecule inside each cell that is crucial for generating energy. As we age, levels of that molecule, NAD+, slowly diminish within the heart. Chiao will study how this occurs, and the role it plays in fatigue, shortness of breath and other symptoms of decreased heart function in older people.

“There is a lot of research looking at NAD+ in aging-related diseases,” said Chiao, who joined OMRF in 2019 from the University of Washington. “What’s different about this study is that we are looking at it only within the mitochondria, the powerhouse of the cell.”

Chiao’s lab will focus on how and why the molecule dwindles in mitochondria and, in future research, whether medication could prevent it from happening.

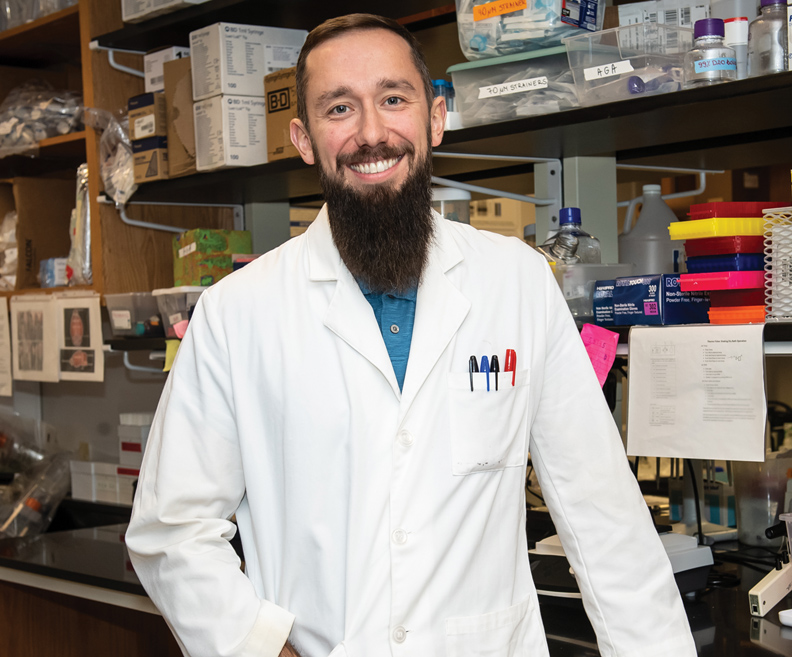

Bubak is among nine scientists nationally to receive a one-year, $60,000 postdoctoral fellowship from the Glenn Foundation. He will explore the decline of skeletal muscle mass and function that begins around middle age.

His research will test whether muscles in older mice become more youthful following a plasma transfer from younger mice, and whether that benefit is enhanced if the donor mice exercise.

“The idea is that we can create a more youthful environment in old mice so that the muscles can respond to stress, such as exercise, like young mice,” said Bubak, who is a postdoctoral researcher in the lab of Benjamin Miller, Ph.D. “If we’re correct, then potentially the application for humans would be both simple and cost effective.”

Future studies will explore how long the youthful effects last following a plasma infusion, he said.

OMRF Aging and Metabolism Research Program Chair Holly Van Remmen, Ph.D., said the two grants ultimately could help reverse two key aspects of aging.

“These two scientists are trying to figure out how to make an older person’s heart and skeletal muscles work like those of a younger person,” Van Remmen said. “We know an active lifestyle prolongs the healthiest period of our lives, but for those who can’t or won’t exercise, this work could someday make a big difference.”

Wetumka Funeral Home Director Faces Felonies

A Hughes County funeral home director turned himself after an investigation by the Oklahoma Insurance Department’s Anti-Fraud Unit. Donald Williamson is accused of embezzling almost $75,000 from 28 families who set up prepaid funeral trusts.

“We take crimes like this very seriously,” said Oklahoma Insurance Commissioner John D. Doak. “People are very vulnerable when it comes to funeral planning. They need to be able to trust their funeral home workers. I commend the investigators of our Anti-Fraud Unit. They will continue to bring justice to Oklahoma consumers.”

Williamson owns Williamson-Spradlin Funeral Home in Wetumka. He admitted to investigators he accepted money for prepaid funeral trust accounts and deposited the money into a bank account for his funeral home from November 2011 to December 2014. By law, prepaid funeral trust account money should go into a separate trust account and not be used for any other purpose.

On Friday, officials from the Oklahoma Insurance Department will be available to meet with anyone who bought a prepaid funeral trust from the Williamson-Spradlin Funeral Home. Residents are asked to bring prepaid funeral trust paperwork to the City of Wetumka Council Board Room at 202 N. Main anytime between 11 a.m. and 2 p.m. Meetings are confidential.

“Our Anti-Fraud Unit worked closely with the Hughes County District Attorney’s office on this investigation. They have been very helpful to our case and aggressive in bringing Mr. Williamson to justice,” said Rick Wagnon, director of OID’s Anti-Fraud Unit. “We have seen cases like this before. In 2011, a Creek County funeral home director was charged with fraud after a similar investigation.”

Williamson will face felony counts of embezzlement and violations of the Prepaid Funeral Act.

The Anti-Fraud Unit is a commissioned law enforcement agency that conducts investigations of various white-collar crimes related to insurance fraud. Oklahomans can call to report fraud at 1-800-522-0071.

DARLENE FRANKLIN: THE THINKERS

As a baby boomer, enough of the 1960s rubbed off on me to make me willing to question everything. I still believe there are absolutes, however, no matter how polically incorrect that may be,

The cataclysm of the Sixties started long before. You could say it began with early man. A survey of what our great philosophers had to say about humanity points to a downward spiral:

During the Iron Age, Israel’s King David asked, “What is man, that [God] is mindful of him?” (Psalm 8:4, NIV), but in Ancient Greece, Plato defined man as “a being in search of meaning.” He didn’t turn to God exclusively or even primarily in the search for his identity.

During the Renaissance, Descartes described humanity’s increasing dependance on their own reasoning. “I think; therefore I am.” No wonder in the last century that Friedrich Nietzsche said, “God is dead. God remains dead. And we have killed him.”

In the wake of the sweeping changes that changed how our nation thought, God raised up warriors to “demolish arguments and every pretension that sets itself up against the knowledge of God.” (2 Corinthians 10:5 NIV) As Francis Schaeffer said, “He Is There, and He Is Not Silent.” I read his books, as well as others by C.S. Lewis, Philip Yancey, and Josh McDowell. What I learned only magnified my commitment to what I already believed by faith.

A generation later. my son struggled at a much deeper level. He wanted to believe in God, but he didn’t know that he could. He read the Bible from Genesis to Revelation, and sought answers to his questions. Now he is an apologist himself, eager to share not only what he believes but why.

I’m proud and grateful for my son’s calling. But it’s not mine. My intellect agrees God is sovereign, but my old way of life tugs me in the wrong directions. The apostle John describes my struggle well: in addition pride in my achievements and possessions, I’m also drawn to a craving for physical pleasure as well as for everything I see(I John 2:16 NLT).

Some of those distractions are outside of my control. In the nursing home where I live, we have several residents with dementia. People suffering from the disease may grow belligerent and offensive

Not everyone is surrounded by dementia patients, but most of us hear offensive language fairly often—at work, at school, sometimes at home and on the media. The best way I know to combat such repulsive thingsis to fill my mind with good thoughts, whatever is true, honorable, right, pure, lovely, admirable, excellent, and praiseworthy (Philippians 4:8, NLT).

No, I don’t have complete control, not even in my room, since I share it. But where I can make a choice, I seek to proactively fill my mind with good things.

I’ve memorized hundreds of Bible verses. I continue to dive into scripture and to write devotions and poetry based on my studies, stockpiling memories for future reference. As hymnist Kate Wilkinson wrote, “May the Word of God dwell richly in my heart from hour to hour.”

I also train myself to have the mind of Christ, to look out for the interests of others before my own (Philippians 2:3-5). When I do, my spirit grows calmer, and I am able to communicate with someone who otherwise annoys me.

If I review the day’s problems at night, wakefulness plagues me. I sleep better when I review memory verses, pray, or sing hymns. Occasionally I create a poem. It doesn’t matter if I remember the lines when I wake up. The process helped me rest.

I also find it helpful to speak frequently of God’s wonderful deeds on my behalf. The more I do, the more His blessings come to mind. Encouragement, not complaints, should come from my mouth.

Bottom line? When I set my mind on things of the spirit, I will prove that God is true, even when every man seems to be a liar. He corrects my hearing and my vision.

Battle of the Mind

Jesus, hosanna, save now

My thoughts may wander

Let me in Your mind abide

You make me stronger.

May I never brood on strife

Rehearsing details

Better to hold Your word tight

Drivers Must Move Over to Save Lives

The Oklahoma Insurance Department is joining forces to spread a life-saving message to drivers: “Move over. It’s the law.” The message is part of an initiative by the Oklahoma Traffic Incident Management Steering (TIMS) Coalition. The Coalition also includes representatives from the Oklahoma Highway Patrol, Oklahoma Department of Transportation, Oklahoma Sheriffs Association, Oklahoma Emergency Management and many more.

“As the holidays approach and more people will be on the road, we’re asking Oklahoma drivers to be more mindful behind the wheel,” said Oklahoma Insurance Commissioner John D. Doak. “Not only is moving over the law, it will help save the lives of first responders and lower the number of costly traffic delays.”

According to the National Highway Traffic Safety Administration, 52 law enforcement officers were killed in traffic-related incidents last year. Oklahoma Highway Patrol Trooper Nicholas Dees was hit and killed last year along I-40. His mother is featured in a new public service announcement which began airing this month. It can also be viewed here.

“Half of me died because of one man that did not move over for emergency vehicles,” said Shelley Russell, Dees’ mother.

Oklahoma’s Move Over law requires drivers approaching a parked emergency vehicle with flashing lights, including wreckers, to move over to the next lane. If the driver cannot move over, he or she is required to slow down. Troopers suggest drivers reduce speed to 15-20 mph or slower. The penalty for failing to slow down or change lanes is a ticket with a fine of more than $200.

Another benefit of drivers abiding by the Move Over law is a reduction in the number of costly traffic delays. According to the Texas Transportation Institute, for each hour a vehicle is stuck in traffic $21 is wasted per vehicle in time and fuel.

One way to ease the burden of traffic is for drivers to move over if they are involved in a non-injury car accident. This allows drivers to safely exchange insurance information and not block the flow of traffic.

“Many drivers seem to think that moving over is just an optional courtesy when they see flashing lights or have a minor wreck,” Doak said. “It’s not optional. Move over. It’s the law.”

Feb/Mar AARP Drivers Safety Classes

Date/ Day/ Location/ Time/ Registration #/ Instructor

Mar 4/ Saturday/ Sulfer Okla./ 9 am – 3:30 pm/ 1-580-622-3016/ Pickle, Murray County Exten. – 3490 Hwy 7 West – Sulfer, Okla.

Mar 8/ Wednesday/ Edmond/ 9 am – 3:30 pm/ 210-6798/ Palinsky

AARP State Office – 126 N. Bryant

Mar 10/ Friday/ Okla. City/ 9 am – 3:30 pm/ 951-2277/ Edwards

SW Medical Center – 4200 SD. Douglas, Suite B-10

Mar 10/ Friday/ Okla. City/ 9 am – 3:30 pm/ 376-1297/ Palinsky

Woodson Park Senior Center – 3401 S. May Ave.

Mar 14/ Tuesday/ Midwest City/ 9 am – 3:30 pm/ 691-4091/ Palinsky

Rose State – 6191 Hudiberg Drive

Mar 18/ Saturday/ Moore/ 9 am – 3:30 pm/ 799-3130/ Palinsky

Brand Senior Center – 501 E. Main

Mar 28/ Tuesday/ Norman/ 9 am – 3:30 pm/ 515-8300/ Palinsky

Silver Elm Estates – 2100 36th Ave N.W.

Apr 4/ Tuesday/ Warr Acre/ 9 am – 3:30 pm/ 789-9892/ Kruck

Warr Acres Community Center – 4301 N. Ann Arbor

Apr 6/ Thursday/ Okla. City/ 9:30 am – 4 pm/ 951-2277/ Palinsky

Integris 3rd Age Life Center – 5100 N. Brookline

Apr 11/ Tuesday/ Yukon/ 9 am – 3:30 pm/ 350-7680/ Kruck

Dale Robertson Senior Center – 1200 Lakeshorse Dr.

The prices for the classes are: $15 for AARP members and $20 for Non-AARP. Call John Palinsky, zone coordinator for the Oklahoma City area at 405-691-4091 or send mail to: johnpalinsky@sbcglobal.net

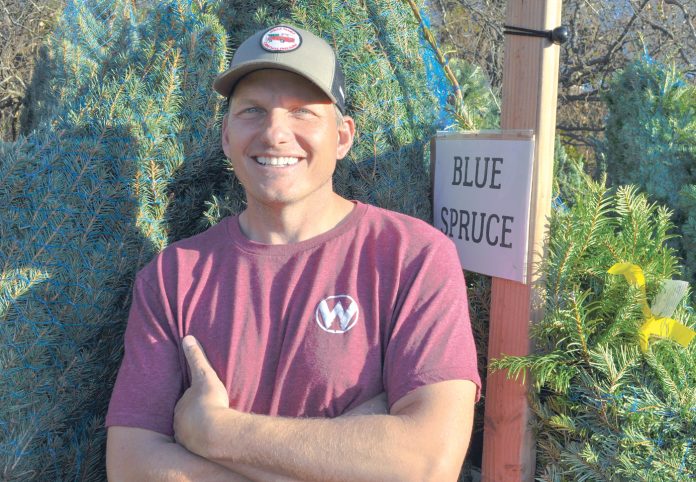

Growing family tradition: Real trees, real memories

by Bobby Anderson, Staff Writer

Jesse Wells is in a growth industry.

The only problem for this urban Christmas tree farmer is that 365 days yields about 18 inches of growth.

But that’s OK. The Wells Family Christmas Tree Farm is in its second year and is already experiencing record growth.

And the lasting memories local families are experiencing by coming together and selecting their Christmas tree has already exceeded any business plan Wells had for the venture.

“You get to do a lot of good stuff,” Jesse Wells smiled, surveying his farm just before opening the gates.

The Norman farm traces its roots back to Thanksgiving 2014 when the Wells family pulled the old artificial tree out of the attic one last time just to give it away.

Neither were raised with real trees but they decided it was the perfect time to take their son to a local tree farm just down the road and start a new family tradition.

Turns out both were thinking the same thing as Jesse sawed away.

“She was having this thought we should (open a farm),” he said. “We didn’t have any idea. This is three years in the making, our second year to be open but we had no clue.”

The Wells family simply provides the trees, what happens from there can be amazing.

A father trying to work his way back into his children’s lives brings the family out. Grandparents show their grandkids what a real tree looks and smells like for the first time.

And young families make memories that will last a lifetime.

“Nobody ever says ‘You’ve got a Christmas tree farm? That’s horrible,’” Jesse says. “Even if they don’t like Christmas trees or Christmas they think it’s a pretty cool deal. It’s just good vibrations, good spirit growing Christmas trees.”

“This is not even really about the trees. They’re a part of the story but it’s more about what people get to experience together as a family when they’re here.”

Jesse Wells never expected to have a Christmas destination just outside his front door but he has one now. The Wayne native now has a full-blown winter wonderland with trees, concessions and games.

“We planned on moving out here and being alone with 12 acres,” Wells laughed.

This time of year, neither Jesse nor Katy sit still for very long. Katy handles the finances and the bulk of the paperwork while Jesse is constantly moving outside.

BUILD IT AND THEY

WILL COME

It’s year two in the experiment but the Wells Family Christmas Tree Farm is already a success.

On this day, Jesse is diagnosing an issue with a customer tree all the while hanging out in the background keeping a watchful eye on a young man from Mississippi who is about to propose to his girlfriend.

“I grew up on land but I grew up hating mowing and raking and pulling weeds,” Jesse said. “I think it was more of the Christmas spirit and I think we both had the idea it would be a cool thing for other families.”

“We’ve always been believers and we’ve always felt this place is God’s place and the house and everything. So this was just kind of an extension of that. So now it’s just having people out here and letting them experience what we get to experience every day.”

Wells went to the University of Oklahoma and now works in the Devon Energy IT department. Katy is a local fitness instructor in addition to running around a 13-year-old son who is active in sports.

Groups have already begun booking private events.

The final week in November local non-profit Hearts for Hearing, a provider of cochlear implants for children, brought 164 adults and 135 children for an evening of tree shopping and celebration.

Fellow farmers told Wells to just order 100 trees last year because, well, you just never know.

They ordered 400.

“We had a good community of friends and really God just stepped in,” he said.

A spot on a local news channel aired that morning.

“There was an immediate flood of people that morning,” he smiled. “We got rid of all our trees in three weeks.”

Stepping out in faith, the Wells’ ordered 1,000 trees for their second year. Some 222 sold the first weekend.

With current planting and growth rates, fresh-cut trees from the Wells farm are still about two years away. At the end of year three, the farm should produce between 400 to 500 each year.

For now they sell trees from Michigan, Oregon and North Carolina. Blue Spruce, Fraser fir, Virginia Pine and a host of other varieties are available.

There are other tree farms in Oklahoma to make memories at. You can contact the Oklahoma Christmas Tree Association to find one close to you.